On this page you can find information about MOVE Bank home loans. Skip ahead to the full table of products or read more about the lender.

Compare MOVE Bank home loans

Compare MOVE Bank home loan products below and hit "load more" to see a fuller selection of loans. You can also find more information on each individual product by clicking "more info".

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseMOVE Bank lender profile

- MOVE Bank was first established in 1968 as the Railways Credit Union to service railway workers and their families. MOVE Bank is a customer-owned financial institution.

- MOVE Bank has 22,000 members and is an accredited deposit taking institution, meaning that deposits with MOVE are guaranteed by the government (up to $250,000).

- MOVE Bank offers investor and owner-occupier mortgages, insurance, credit cards, personal loans and car loans.

How do I apply for a MOVE Bank mortgage?

If you'd like to apply for a home loan from MOVE Bank, please contact the lender directly.

Eligibility

Each MOVE Bank product has specific eligibility criteria but some will apply to all products. For example:

- Age. You must be over 18 years of age.

- Residency. You should be a resident of Australia.

- Employment. You should have a regular source of income.

Documents required

When you apply for a mortgage with MOVE Bank you are required to provide certain information so make sure you have all your documents ready before you apply. The documents you will be expected to provide are:

- Identification documents. You will need identification such as a driver's license, passport or birth certificate.

- Proof of income documents. Recent payslips can establish your income.

- Asset and liability documents. You need to provide documents showing your current assets (savings accounts, investments) and liabilities (your outstanding debt).

Detailed guide to home loan applications and paperwork

Looking for more mortgage options?

- Online lenders. Compare more mortgages from online lenders.

- Big Four banks. Check out home loan rates from Australia's Big Four banks.

- Investors. Compare loans for property investors.

- Mortgage brokers. Find out how to get free, expert guidance from a mortgage broker.

Compare other products from MOVE Bank

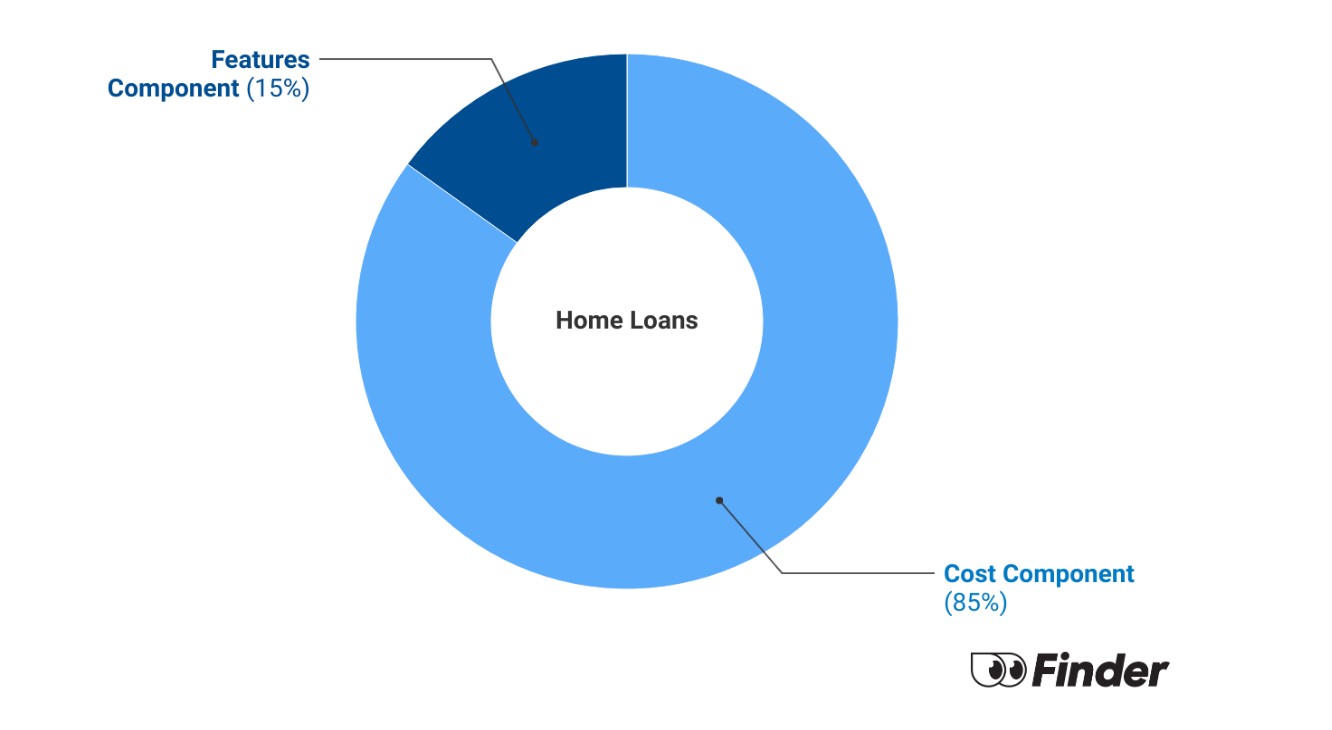

What is Finder Score?

The Finder Score crunches 7,000 home loans across 120+ lenders. It takes into account the product's interest rate, fees and features, as well as the type of loan eg investor, variable, fixed rate - this gives you a simple score out of 10.

To provide a Score, we compare like-for-like loans. So if you're comparing the best home loans for cashback, you can see how each home loan stacks up against other home loans with the same borrower type, rate type and repayment type. We also take into consideration the amount of cashback offered when calculating the Score so you can tell if it's really worth it.

Read the full Finder Score breakdown

Ask a question

More guides on Finder

-

How to repay a home loan faster

No one wants to spend years and years paying off what ends up being mostly interest. Here are several tips on how to pay off your home loan faster.

-

Average house deposit for first home buyers in Australia

How much does the average Australian home buyer need to save for a house deposit?

-

How to get a home loan in Australia in 8 step

Taking out a home loan can seem like a huge mountain to climb. But when you break it down into these 10 key steps, it becomes much easier.

-

Home loan cashback offers

Home loan cashback deals can help you refinance to a cheaper interest rate and get a lump sum cash payment. Compare the latest deals and check your eligibility today.

-

Calculate the income needed to buy a home in any suburb in Australia

Work out how much you need to earn to buy a house in any Australian suburb.

-

How can seniors get a home loan in Australia?

If you're over 55, use this guide to find out how to select the right mortgage for you.

-

What happens when you pay off your mortgage?

Now that you've paid off your mortgage, find out how to finalise your home loan and where to invest your money next.

-

Getting a home loan on maternity leave

Some lenders will approve a home loan even though you’re not receiving a permanent income. However, you’ll need to undergo some assessments.

-

Home loan fees

Most home loans will charge fees of one type or another. Read our guide and learn what you might be in for, rough estimates on how much each fee costs and some methods to avoid them.

-

Home Loans for Pensioners

Pensioners can have a tough time getting a home loan because each lender treats pension payments differently. Here are some tips you can use to find out whether or not you could get a home loan.